Prep For Care

/Preparing for Long-Term Care: Your Risks and Financial Options

By NATALIE JONES

Long-term care includes a number of services that are intended to help people live with greater independence when they can no longer care for themselves. However, long-term care can be expensive. On average, care costs $6,844 per month for a room in a nursing home, $3,698 for a unit in an assisted living facility, and $20 per hour for a home health aide. It’s important to plan for these expenses as early as possible, whether you think you’ll need long-term care or not. The Borrego Springs Senior Center presents some things you need to know about long-term care.

Start Planning ASAP

CNBC recommends that you start planning for your long-term care needs no later than the age of 50. That way, you aren’t left spending every dollar in your savings account to pay for your care at the last minute. Being well-prepared to handle the realistic expenses involved in long-term care will help you maintain your financial and lifestyle goals as you age.

Your likelihood of requiring long-term care depends on a variety of factors, from hereditary illnesses to your current lifestyle choices. First of all, find out if there are any genetic conditions that you should be aware of. For example, cancer, heart disease, and arthritis may be passed along through a family’s genes. The medical history of your immediate family members, such as your parents, grandparents, and siblings, is the most critical.

Next, take a look at some lifestyle factors that can play a role in your susceptibility to illness and injury in the future. These include your exercise and eating habits, stress levels, whether you smoke and drink, and how much quality sleep you get every night; click here to learn how poor habits affect your health as you age. According to Verywell Health, it’s never too late to make positive changes to your lifestyle. This means quitting smoking, adding more nutrient-dense foods to your diet, joining a fitness program, and learning stress-reduction techniques.

Falls are the number one cause of serious injury for seniors. Make sure you take every precaution to prevent these dangerous accidents in the home so you can avoid long-term care. Installing sturdy rails along hallways and stairways while replacing slippery flooring with non-slip options is highly recommended. In the bathroom, install grab bars and a night light. It's also a good idea to keep your floors uncluttered and free from bunching rugs to prevent tripping.

Your Options for Covering the Costs

Insurance

You have various options for funding long-term care, from using your personal savings account to getting a long-term care insurance policy. According to InvestmentNews, traditional long-term care insurance is losing popularity. Instead, many people are opting for combined life insurance and long-term care policies. This is a more flexible insurance option, allowing you to use the money for care. If not, the policy will provide your beneficiaries with a death benefit instead.

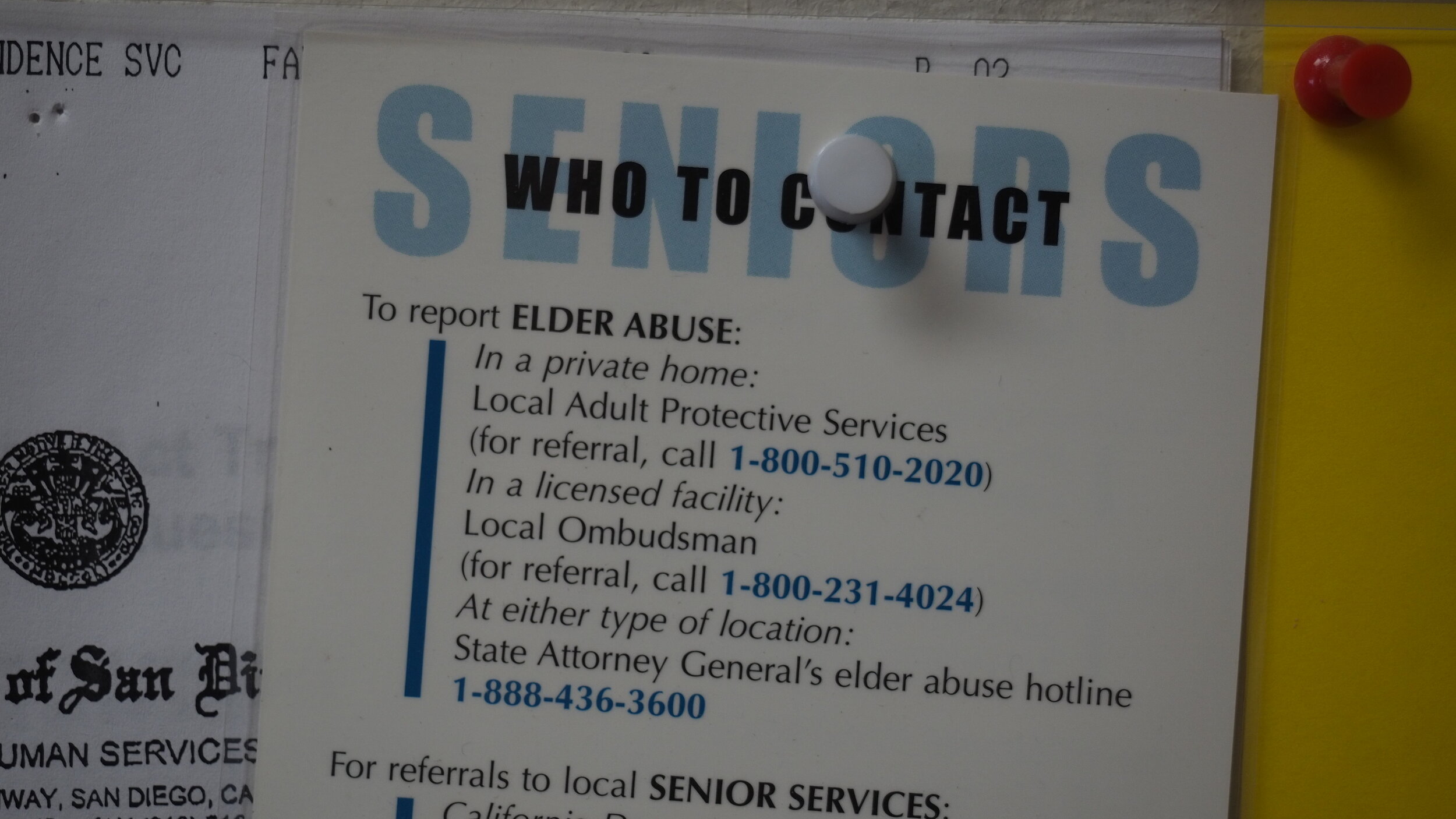

Medicare

Many seniors also rely on Medicare to cover hospital visits, prescription drugs, and medical expenses. Keep in mind that Medicare will not cover the costs of many of your long-term care needs, such as homemaker-type services and care facility lodging. Of course, it is still an invaluable tool. Make sure you stay up to date on any changes occurring to the plan you’re currently enrolled in. Remember, the Medicare Annual Enrollment Period (AEP) occurs between October 15 and December 7. This is the time to make any changes to your health and prescription drug plans so they better suit your needs next year.

Medicaid

Medicaid may also assist your long-term care costs, but only if you meet the strict eligibility requirements. Medicaid is specifically for people who are impoverished, so you must spend almost all of your assets before being eligible. Although you shouldn't strive for this goal, Medicaid can be a lifesaver if you run your savings account dry.

Importantly, don’t forget to communicate your care wishes to your family. Your family members may not be aware of the kind of care you desire. Keeping open conversations with everyone involved will ensure there are no surprises, prevent misunderstandings, and let everyone know what their personal responsibilities are.