The Stress of Retirement

/Common Retirement Stressors and How to Handle Them

By Rhonda Underhill

Senior life can be restful and relaxing in a lot of ways, but it’s absolutely not without its own unique set of stressors. Stress is certainly a natural part of everyday life, but it’s also true that stressful issues that specifically impact senior citizens can put them at risk mentally and physically. Seniors may have a harder time dealing with stressful situations, which is why it’s best to have plans in place that will help you to avoid or mitigate high-anxiety events that seniors sometimes have to face.

There are a few different signs you can look for that indicate stress has started to take a serious toll, such as disrupted sleep schedules, changes in appetite or mood, unusual behavioral patterns, and weight loss. Whether you’re a senior or caring for a senior, check out a few of these handy strategies which can help you reduce some of the common stressors seniors face.

At Borrego Springs Senior Center, we hope to soon resume activities and programs that support senior health and help to relieve stress. Please consider making a donation, and feel free to contact us for more information about our center.

Change Your Mattress for Better Sleep Quality

Are you having a tough time getting to sleep at night? Do you suffer from chronic back pain? If these scenarios apply to you, it’s important to know that consistent lack of sleep can lead to greater stress levels (not to mention a slew of other health problems). In order to stay on the path to good health, you need to focus on treating your back pain. One way to do this is by purchasing a new mattress that provides proper support.

Before shopping for a mattress, keep in mind that not all beds are created equal. The right mattress can give you immense relief from your back pain, but you’ll have to choose one that suits your sleep style in order to fully reap the benefits.

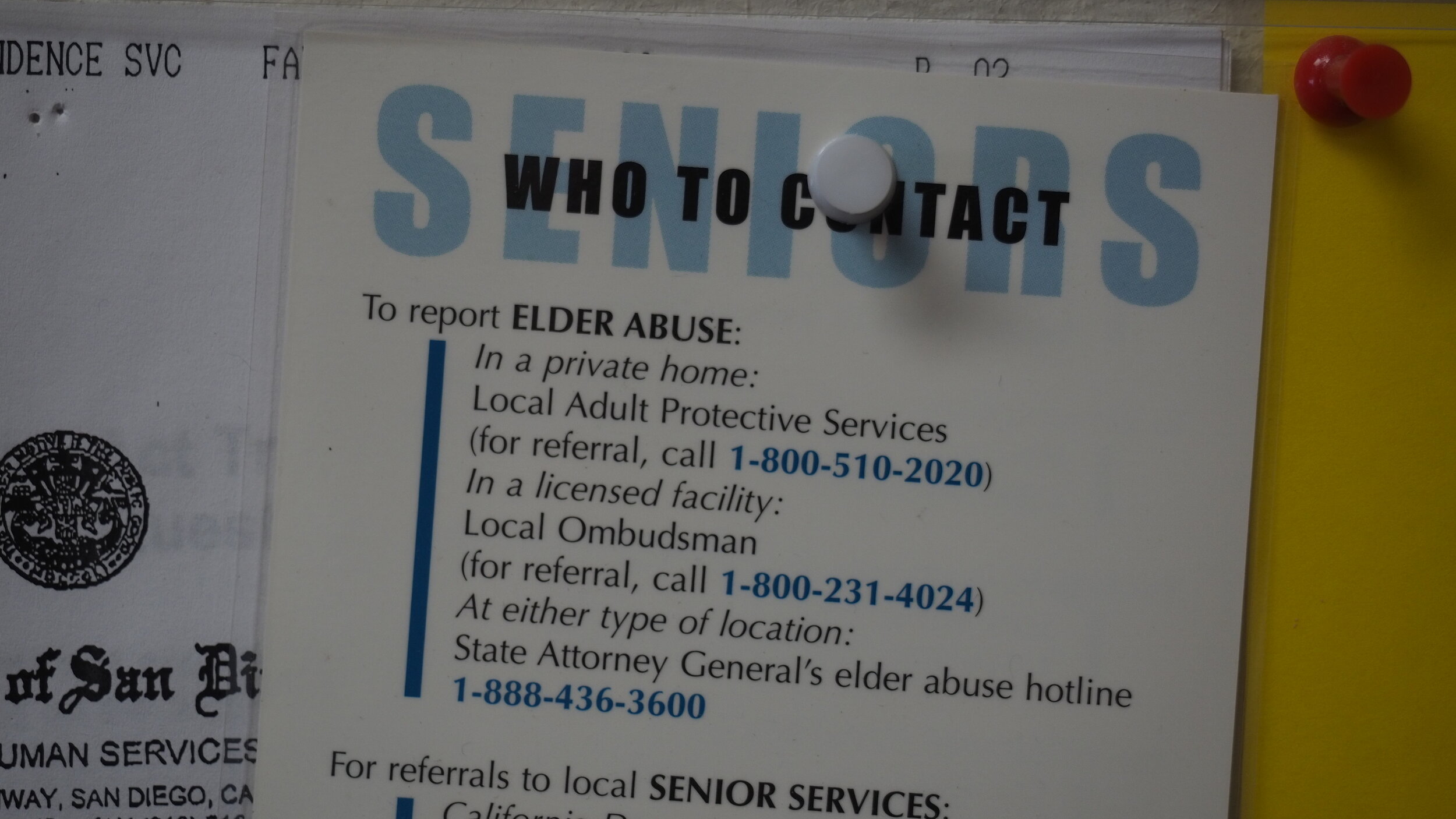

Find Ways to Save Money on Medicare

Proper healthcare becomes a lot more urgent during retirement years, as health problems can present themselves more frequently, while the income that might make them easier to deal with gets significantly diminished. Medicare can become extremely important to a retiree, but it doesn’t cover everything.

One option is to enroll in a Medicare Advantage plan by going through a private insurance company. These plans can give you access to expanded coverage and increased benefits when it comes to prescription medications and dental and vision care, which can save you money in the long run. Signing up for a Medicare Advantage plan is a great way to eliminate some of the stress that can come from dealing with healthcare expenses during retirement.

Set Yourself Up with a Supplemental Income

When it comes to your finances, post-retirement living can be tricky. Limited income and increased healthcare costs can combine to make it difficult to figure out how you’ll make your money last. It’s not impossible, however, to live comfortably through your retirement, with the right strategies in mind.

Try supplementing your income with an easy job that can allow you to pull in extra money from the comfort of your own home. Online selling is a great way to make money, with options like eBay and Amazon making it easy for just about anyone to earn some extra cash from the comfort of their own home.

While setting up your supplemental income, it may help to put together a budget to see how you can apply this additional money to the areas that need it most. For instance, if you’re in debt, figure out how to maximize this income so you can pay it down. If necessary, get in touch with a debt relief specialist who can help you figure out a plan. That way, you can reduce the amount of debt you have in retirement.

Make Your Home as Safe as Possible

There’s something to be said for the stress relief that can come from eliminating safety hazards in the home. Falls become a much more pressing concern during retirement years, which is why a safer home can go a long way when it comes to eliminating undue stress. There are plenty of ways you can make your existing home safer, adding safety features like extra lighting and grab bars to eliminate fall risks.

Downsizing might be a good option, as well. Moving into a smaller home can not only eliminate safety hazards, but also cut down on living expenses in a way that really helps to ease your financial burden.

Eliminating Stress Doesn’t Have to Be Difficult

As you make your way through your retirement years, there are many effective ways to cut down on common stressors. Unsurprisingly, many of them have to do with health and finances, either directly or indirectly. As such, finding ways to help yourself deal with either issue is almost guaranteed to help you reduce unwanted anxiety.